Mediterranean Shipping Co. has launched an independent, direct service between India and the US East Coast, a premium product that industry observers believe has the potential to capitalize on US importers’ resurgent needs for priority loading and time-definite delivery as they diversify sourcing away from China.

A total of eight ships have been reportedly deployed on the weekly loop, branded as the Indusa. The schedule includes two port calls on India’s west coast — Nhava Sheva (Jawaharlal Nehru Port Trust) and Mundra — which together handle the bulk of the country’s containerized freight.

The Indusa port rotation is: Mundra, Nhava Sheva, Colombo, Valencia, New York, Savannah, Norfolk, and Mundra. The vessel MSC Ludovica made the inaugural call at Mundra on Tuesday.

The new string boasts a declared transit time of 34 days from Mundra to Norfolk.

Concurrent with the launch, MSC readjusted the rotation of its existing Indus Express Service linking India, the Middle East, and USEC by canceling a call it added at Sri Lanka’s Colombo port last month. The rearranged itinerary is: Abu Dhabi, Jebel Ali, Karachi, Nhava Sheva, Mundra, Haifa, New York, Charleston, Savannah, Freeport, Houston, Freeport, Valencia, King Abdullah Port, Abu Dhabi, Jebel Ali, Karachi, and Mundra. Noting the Indusa retains its focus around northwestern India markets, the Geneva-based liner said the Indusa has been designed to connect southeast India, Sri Lanka, and Bangladesh to the US East Coast via Colombo — meaning transshipment for regional cargo.“Both services will operate as standalone MSC services, offering competitive transit times from the Middle East and Indian Subcontinent region to the US East Coast,” the carrier said. “Our US customers benefit from the possibility to import cargo from anywhere in India, boosting predictability for effective supply chain planning.”

From an industry perspective, the Indusa will directly compete with the Indamex Service, a joint operation between Hapag-Lloyd, CMA CGM, and OOCL. The Indamex rotates Karachi, Nhava Sheva, Mundra, Damietta, New York, Norfolk, Savannah, Charleston, Port Said, Jeddah, and Karachi. Since its entry in 2000, the Indamex has been the most sought-after ocean offering on the India-US trade lane.

Ironically, at JNPT, DP World Nhava Sheva hosts calls from both these competing services. Further, the call expansion coincides with the Dubai-based company signing a deal to buy domestic short-sea carrier Shreyas Shipping as it works to cement its position as a container logistics integrator in the country. Officials at DP World Subcontinent were unavailable for comment.

India slow to take advantage of sourcing shift

While there has been a discernible shift in global sourcing patterns toward countries in Southeast Asia, India has yet to become a key beneficiary of that evolving migration, with the challenges tied to its ocean supply chains seen as a big barrier to larger trade aspirations. The turmoil unleashed by the COVID-19 pandemic — blank sailings, congestion at foreign transshipment points, and equipment inventory dislocations — has only exacerbated those pain points, according to industry leaders.

“There are challenges owing to space constraints in various trade lanes at the moment that are likely to impact US bookings,” Adarsh Hegde, joint managing director of freight forwarder Allcargo Logistics, told JOC.com. “We are helping our customers by rebooking cargo in alternative routes in our endeavor to mitigate the logistics logjam and ensure deliveries as per schedule. ”Hegde also noted the group’s digital marketplace — ECU360 — has been particularly useful for customers to explore multiple routing options in a capacity crunch scenario.

While container lines active in Indian trades continue to face significant demand downfalls from the pandemic, the main domestic ports are seeing an uptick in cargo activity. JNPT’s August volume rose to 352,738 TEU from 283,802 TEU in April when a stricter, country-wide lockdown was in force.

Container shortages in Asia expected to intensify

.Equipment shortages in Asia are worsening as importers in the United States and Europe struggle to return empty containers to China and other Asian manufacturing hubs, casting doubt as to whether the international supply chain will be ready for the upcoming peak shipping season.

The container imbalance has been caused primarily by the spike in imports to the US and Europe in July and August following the reopening of their economies following lockdowns put in place in the early days of the coronavirus disease 2019 (COVID-19). Now, carriers are having difficulties repositioning the empty containers for return to load ports in Asia, especially China, according to carriers and non-vessel operating common carriers (NVOs).

Containers of all sizes — 20-foot, 40-foot, and 40-foot high-cube — are in short supply. Jon Monroe, a consultant to NVOs, listed in his weekly newsletter Wednesday nine load ports in China that are short on containers to various degrees. As a result, exporters in China are grabbing whatever containers they can, even if it means downsizing to containers that carry less freight at a higher cost to beneficial cargo owners (BCOs), he said.

“There are plenty of reports out there that a lot of equipment — I mean, I’m not talking for Maersk, but for the industry, if you will — has been stuck in Europe and the US and other importing regions and is slow in finding its way back to Asia,” Maersk CEO Søren Skou said on the company’s Q2 earnings call on Aug. 19.

In addition, typhoons and fog are throwing vessels off schedule in China, South Korea, and Japan, in some cases resulting in liner services skipping port calls to avoid weather issues and not dropping off empties, thereby contributing to the shortages.

“There are a multitude of reasons [for the container shortages]: a trade imbalance from Europe and the US to Asia, bad weather, and a cargo rush ahead of the weeklong shutdown for China’s National Day holiday,” said Sundara, director of ocean freight for Asia Pacific at Scan Global Logistics.

Shortages ‘only going to get worse’

NVOs do not see the container shortages in Asia dissipating any time soon. “The equipment shortage is massive, and it’s only going to get worse,” said David Bennett, president of the Americas at the NVO Globe Express Services. Bennett sees the strong demand in the US for e-commerce merchandise and medical supplies, such as personal protective equipment, lasting into October, and probably beyond that.

In the US, warehouses, especially those in Southern California, have been overwhelmed by imports over the past two months. Productivity at the import warehouses is down as employers space out workers for safety reasons. Also, logistics companies report a shortage of workers at the warehouses due to COVID-19. As a result, containers, and the chassis they sit on, are remaining at warehouses much longer than they normally would. To alleviate this problem, ocean carriers, who for years had been granting extended free time for equipment storage to retailers and other large customers in order to retain their business, are now cutting back on free time, according to NVOs. While carriers continue to honor the traditional three or four days of free storage time, customers, even large retailers and importers that had been given 20 days or more of additional free time, are seeing those times reduced dramatically, according to one NVO who requested anonymity,

James Caradonna, general manager pricing/Americas at M&R Forwarding and Multi Container Line, said that when customers request extended free time now, the NVO is in a position where it has to explain to the consignee some carriers are now backtracking from free-time extensions. NVOs are now telling their BCO customers the answer is “no” because carriers want the equipment back in Asia as quickly as possible, Caradonna said.

The ability of carriers to cut back on free time reflects the leverage carriers now have in a market where space and equipment are at a premium, he said. “If a carrier were compelled to extend a longer free period to a shipper due to competitive dynamics, they are less compelled today,” said Caradonna.

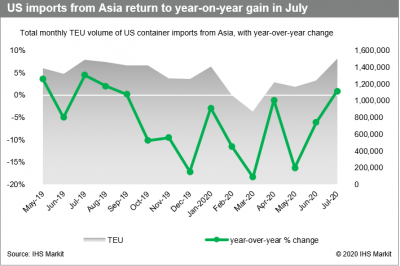

Click to enlarge.

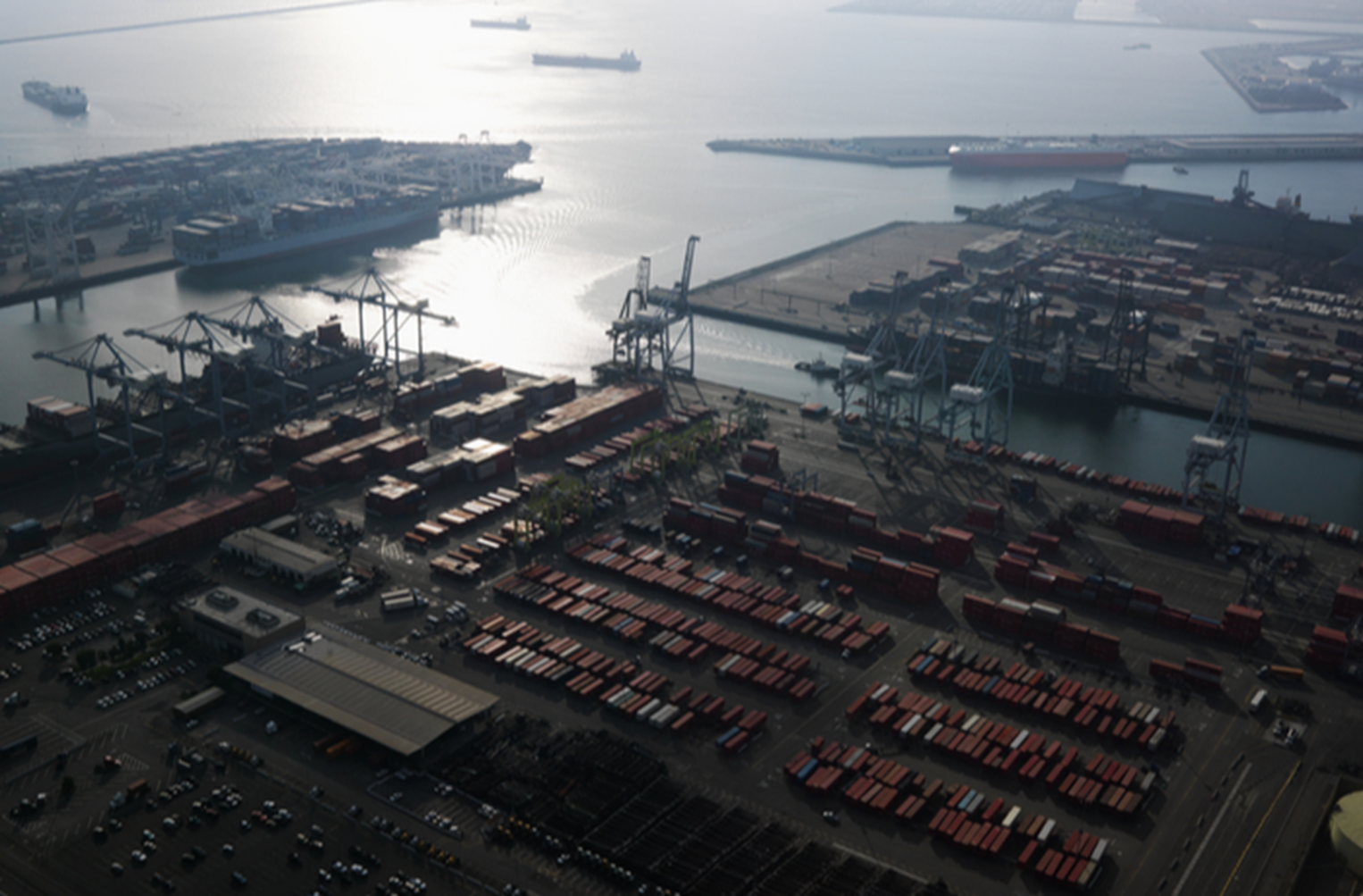

A source within the Los Angeles-Long Beach port complex who asked not to be identified said if carriers resist requests from BCOs for free-time extensions beyond the normal three or four days, the entire supply chain will benefit. When large BCOs negotiate with carriers for extended free time, which is common in Los Angeles-Long Beach, the ports have said over the years it contributes to container and chassis shortages during high-volume periods such as during the peak shipping season.

“It’s gotten to the point where we have to say [to the BCOs], ‘You are part of the problem,’” he said.

Importers in Southern California’s Inland Empire face the challenge of finding enough truck capacity to return empty containers to the ports, said Weston LaBar, CEO of the Harbor Trucking Association (HTA). The problem is compounded by the difficulty truckers are facing in securing appointments for the return of empties to the marine terminals, he said.

Logistics companies say demand for empty returns is a big problem. “It’s becoming increasingly harder to pre-appoint empty container returns for retailers,” said Brian Kempisty, founder of Port X Logistics. “Now, it can take two to three days to get an appointment, largely because plenty of slots are booked but not used.” Due to their inability to get appointment slots for empty returns, LaBar said some truckers are booking multiple slots when they can, but are not canceling the slots they don’t use. He said the HTA is working with terminal operators to correct this problem.

Importers paying extra to secure equipment, vessel space

The logistics problems in Asia and Southern California are pushing up the delivered cost of imports in the US. Customers who are desperate to obtain containers and secure space on vessels leaving Asian ports are willing to pay hefty surcharges on top of record-high spot rates for ocean voyage. Shippers are paying surcharges to guarantee receipt of equipment and to secure slots on vessels at the Chinese ports. Carriers are also charging additional fees to guarantee priority unloading at US ports and delivery to railroads and truckers.

Carriers each have their own name for these guaranteed programs, and according to a spreadsheet provided by an NVO who asked not to be identified, the individual surcharges for these guarantees range from $300 to $1,950 per container, on top of record-high spot ocean rates from load ports in China to the US East and West coasts.

Pricing from Asia to the US West Coast reached $3,758 per FEU on Friday, up 3.3 percent from last week and 140 percent from the same week a year ago, according to the Shanghai Containerized Freight Index (SCFI), which is published in the JOC Shipping and Logistics Pricing Hub. The Asia-US East Coast rate hit $4,538 per FEU, up 7.9 percent sequentially and 72.5 percent year over year. Carriers are in such desperate need of containers in China that some lines are refusing to accept bookings to India and other Asian locations, said Alan Baer, president of NVO TTS Worldwide. “They want to get the containers to China,” he said.

LA-LB cements role as top e-commerce port gateway — at a cost

The wave of e-commerce shipments flowing through Southern California are a mixed blessing for the Los Angeles-Long Beach (LA-LB) port complex, boosting imports from Asia to a two-year high but stressing the entire regional supply chain from the ports to distribution warehouses.

In one sense, the import surge underscores how well-positioned the largest US import gateway is to capitalize on growing e-commerce shipments, even if online spending growth regresses to the mean as Americans become more comfortable shopping in physical stores when the COVID-19 pandemic fades.

Responding to surprisingly strong consumer demand, e-tailers are drawn to LA-LB because of its shorter transit to the Midwest. Importers save about two weeks in transit time to the US interior by shipping via intermodal rail through the West Coast compared with the East Coast routing.

And even costlier expedited ocean services are a bargain compared with the air cargo rates out of Asia. Phillip Tran, director of international services North America at APL Logistics, said that all-in door-to-door delivery costs from Asia to the US interior are 75 percent less costly than air freight. As of late August, the average spot air freight rate from Shanghai to North America was up 20 percent from a year ago, according to the TAC Index. However, given the strength of demand, some e-tailers still had to turn to air services, as North America was the only global region to see year-over-year air cargo volume growth in July, according to the International Air Transportation Association.

For many e-tailers, ocean shipping through LA-LB is the only option. The gateway’s network of services to and from Asia makes it easier and faster to build less-than-container loads at Asian origins. That suits the vast majority of e-tailers, which are small and medium-sized and do not have a four- or five-corner distribution strategy that allows their bigger counterparts to ship through other coasts.

Faster options

Container lines and forwarders have responded to the e-commerce demand accordingly. CMA CGM in late August unveiled two new expedited solutions on the trans-Pacific offering priority loading, discharge, and inland delivery to containers shipped through LA. Last month, APL Logistics added Haiphong, Vietnam, as the 13th Asian load port to its OceanGuaranteed product. That product features priority loading in Asia and time-definite delivery to destinations throughout North America through the use of team truck drivers from LA. Expedited trans-Pacific services offered by Matson Navigation Co. and Zim Integrated Shipping Services have also been in high demand in recent months, forwarders and carrier executives tell JOC.com.

An analysis of data from PIERS, a sister company of JOC.com within IHS Markit, shows that whether it is for e-commerce or inventory restocking, importers and their forwarders and carrier partners are favoring LA-LB. In July, the ports handled their largest share of Asian imports heading into the US since April 2018, at 53.7 percent.

So much volume, so soon

However, that growth has come at a cost. Since late June, LA-LB marine terminals have struggled with congestion and there is no immediate signs of letting up, considering that carriers and forwarders said volume forecasts from shippers are strong through at least Golden Week, which runs from Oct. 1–8.

It is the worst congestion since Hanjin Shipping collapsed in 2016, said Brian Kempisty, founder of Port X Logistics. Warehousing and transloading capacity restraints, owing to pandemic-slowing productivity and new hiring, have put extra pressure on marine terminals.

It is becoming increasingly more difficult to pre-appoint empty container turns for retailer customers, Kempisty said. Before the most recent surge in imports from Asia, a driver could pick up an import container and then return the empty container, a move that had been scheduled with the marine terminal in advance. Now, it can take two to three days to get an appointment, largely because plenty of slots are booked but not used. Additionally, if the consignee is not ready to receive the container for unloading, the empty return appointment can be missed. And the driver can be tied up waiting for the unstuffing of the container and lose their ability to make another truck move that day.

Frustration among truckers is mounting. In an Aug. 18 letter, harbor truckers urged LA-LB ports to consider using their tariff authority to incentivize ocean carriers to share more shipment information with shippers and truckers to increase cargo velocity. Too much of the information needed by cargo owners, terminal operators, and truckers to plan for the return of empty containers to the ports is not being shared by container lines’ operation staff, said Weston LaBar, CEO of the Harbor Trucking Association.

“Right now, the problem is on the empty side. The empty returns are where the disconnect is,” LaBar said.

In the meantime, the surge of e-commerce volumes, which is putting pressure on the supply chains of all shippers, not just e-tailers, is sparking questions about just how sustainable the volumes are and just how much shippers are willing to pay for expedited service. For example, given the equipment issues at LA-LB, Port X Logistics is considering acquiring up to 200 chassis and renting a 4-acre lot to store and transload at a 25,000-square-foot facility, said Kempisty.

“Do we buy 200 chassis and spend $1.2 million in yard space rent and bet that people will pay a higher price for better chassis and throughput?” he asked. “Is it worth doing this with all the peaks and valleys” in volumes?

Summer surge shows in US August imports from Asia

US imports from Asia in August jumped 34 percent from June, driven by ongoing strong demand for e-commerce fulfillment and personal protective equipment (PPE). Imports from China alone last month were up 32 percent from June.

The significant two-month gain shows the full force of the import surge that began in late June with the reopening of the US economy following lockdowns in the early days of the COVID-19 pandemic.

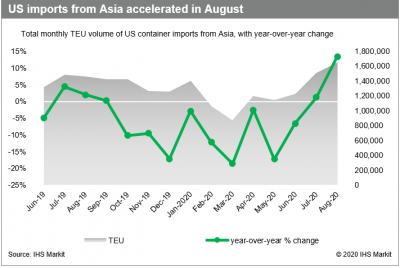

Click to enlarge.

US imports from all of Asia accelerated from 1.23 million TEU in June to 1.5 million TEU in July to 1.65 million TEU in August, according to PIERS, a JOC.com sister company within IHS Markit. That 450,000 TEU gain from June to August meant a 34 percent jump in imports over the summer. August’s imports from Asia were up 13.4 percent from a year ago. Imports from China accounted for 1.1 million TEU of the 1.65 million TEU from Asia in August, marking the first month that imports from China exceeded 1 million TEU since December 2018. The China figure was up from 827,203 TEU in June and 990,109 TEU in July.

August imports from China were up 16.5 percent from last year. China is a large producer of two of the major drivers of imports from Asia: e-commerce fulfillment and PPE. In the first seven months of 2020, imports of PPE totaled 395,455 TEU, up 38 percent over the same period last year. Monthly imports tracked by PIERS highlight the abrupt change in imports from Asia and China that took place this summer. Early in the year, production in China collapsed when COVID-19 emerged there. Consumer demand in the US plunged in the spring during the subsequent US lockdowns. Despite two months of growth, however, imports from Asia are still down 7.4 percent year-to-date through August compared with the first eight months of 2019. Imports from China are down 9.2 percent. August was the first month in 2020 that total US imports globally increased year over year. August imports were up 11.7 percent from August 2019, after declining 2.5 percent in July from July 2019. Year-to-date, total US imports are down 5.2 percent.

Import surge affecting ports, supply chains differently

The volatility in imports this year has had an uneven impact on supply chains at US ports and on inland transportation. The just-in-time nature of many imports caused retailers to concentrate their imports in Los Angeles-Long Beach. West Coast ports in general attract time-sensitive shipments destined for the US interior because importers save 10 days to two weeks in delivery times compared with all-water services from Asia to the East Coast. Southern California, with about 1.8 billion square feet of warehouse space, can respond quickly to import surges.

This summer, however, the ports of Los Angeles and Long Beach and the Southern California infrastructure linked to the ports were overwhelmed by the container volume. The result was marine terminal congestion, chassis shortages, and slower processing of shipments at import distribution centers due to safety measures and worker shortages. Also, spot ocean rates in the eastbound trans-Pacific increased from $2,704 per FEU on July 24 to $3,758 per FEU last Friday, according to the JOC Shipping & Logistics Pricing Hub published on JOC.com.

Click to enlarge

Also, over-the-road truck rates from Southern California to Chicago doubled, and railroads assessed surcharges on intermodal shipments to the eastern half of the nation.

Meanwhile, year-over-year import volumes at several large East Coast ports declined in July even as imports through Los Angeles-Long Beach increased 14 percent from July 2019. However, East Coast port executives told JOC.com they anticipated strong growth in imports in August and September.

Sustainability of import growth uncertain

Carriers, retailers, and non-vessel operating common carriers (NVOs) are uncertain how long the import boom will continue. NVOs told JOC.com they expect imports to remain strong at least through October. In past years, September and October were the busiest months as retailers shipped their holiday-season merchandise. This year, the August Global Port Tracker, which is published by the National Retail Federation and Hackett Associates, projected year-over-year imports will decline 13.3 percent in September and 9.9 percent in October. However, with the strong growth in online shopping, continued demand from in-home office supplies and exercise equipment, and the ongoing requirements for PPE, some NVOs with contacts at factories in China say imports could remain elevated through the end of the year.

US retailers boost forecast for peak season imports

US retailers, after significant growth in imports this summer, have revised upward their short-term forecast for volumes ahead of what they now see as a better-than-expected holiday season.

The rosier forecasts parallel what non-vessel operating common carriers (NVOs) have been seeing in volume forecasts from their customers.

The Global Port Tracker released forecasts on Wednesday that September imports will increase 1.1 percent from September 2019. Though a modest year-over-year gain, it is up sharply from the 9.4 percent decline the group forecast last month. Imports in October are now forecast to fall 9.2 percent year over year, an improvement from the 10.4 percent drop in last month’s report.

Still, the September Global Port Tracker, which is published for the National Retail Federation by Hackett Associates, projects year-over-year declines in imports as traditional holiday season shipments diminish in November and December. It forecasts that November imports will be down 6.8 percent from November 2019, down from the 5.8 percent decline in the prior report. December imports are seen dropping 9.6 percent from last year, slightly more optimistic than the 11 percent decline forecast in August. Global Port Tracker said Wednesday that imports surged to “unexpected high levels” this summer as the US economy continued to reopen from shutdowns related to the coronavirus disease 2019 (COVID-19) and retailers began to stock up for the holiday season.

Click to enlarge.

US imports were indeed robust in August. Containerized imports from Asia increased 13.4 percent from August 2019, and imports from mainland China were up 16.5 percent, according to PIERS, a JOC.com sister company within IHS Markit. Total US imports globally increased 11.7 percent.

Traditionally, so-called peak season imports include large volumes of merchandise for holiday shopping and, therefore, are normally strongest in September and October, giving retailers time to move goods from the ports to store shelves in time for Black Friday sales the day after Thanksgiving. This year, the COVID-19 pandemic has disrupted the normal seasonal shipping pattern, as holiday merchandise competes with e-commerce fulfillment and personal protective equipment (PPE) for vessel space.

Although in-store shopping remains limited, much of that demand is being satisfied online, and consumer demand has rebounded sharply from the lows experienced in April and May, said Jonathan Gold, NRF vice president for supply chain and customs policy.

“It’s important to be careful how much to read into these numbers after all we’ve seen this year, but retailers are importing far more merchandise for the holidays than we expected even a month ago,” Gold said in a statement accompanying Wednesday’s report.

NVOs also revising forecasts higher

NVOs in recent weeks have told JOC.com they have been revising their volume forecasts higher based on what they are hearing from customers and factories in Asia. A consensus is building that imports from Asia should remain strong at least through October.

There is also a feeling among some NVOs that the import surge will not end in October. “We expect to be busy through the holidays, for sure,” Kevin Krause, vice president of ocean services at SEKO Logistics, told JOC.com Wednesday. Krause said he is seeing indications that “post-Christmas season ordering” has begun, including orders for Valentine’s Day and St. Patrick’s Day.

With home remodeling on the rise during the COVID-19 pandemic, and the price of lumber and other building materials increasing, home-improvement retailers do not want to be caught with gaps in their stocks and empty shelves, as occurred this summer, said Jon Monroe, a consultant to NVOs.

“There has to be a replenishment. They’re building inventories for next year,” Monroe said.

Nevertheless, the outlook beyond October is still somewhat cloudy, given uncertainties around how quickly the US and other nations will recover from the economic impacts of the COVID-19 pandemic.

“Data from around the globe is a mix, with a weak recovery as Europe struggles with rising COVID-19 numbers, but China’s exports remain solid. Will it last? A lot of uncertainty is in play,” said Ben Hackett, founder of Hackett Associates.

Chinese authorities suggest trans-Pacific carriers add more capacity

Chinese authorities have suggested to major container lines that they inject more capacity and less aggressively raise rates in the trans-Pacific trade as spot rates hit highs, adding an entirely new element to an already volatile market, carriers and forwarders tell JOC.com

The ministry of transportation and communications on Friday gave the guidance to a group of major carriers at a Shanghai meeting where new capacity reporting requirements were discussed. Two container lines executives — one with a Europe-based and the other with an Asia-based carrier — said Cosco Shipping has agreed to suspend a Sept. 15 general rate increase. Cosco’s decision to suspend the GRI is being shared with its customers, according to two forwarders and one forwarder’s advisory of the GRI suspension to costumes.

Container lines’ ability to adjust trans-Pacific capacity has been key to lifting their profits despite lower global container volumes. Carriers enjoyed their most profitable second quarter since 2010, posting a total profit of $2.7 billion, according to the latest Sunday Spotlight report from Sea-Intelligence Maritime Analysis.

If carriers do in fact heed Chinese regulators’ direction, “it would be an unprecedented impact on the market, and more worryingly, potentially derail the carriers’ ability to manage capacity in the face of extreme demand volatility,” said Lars Jensen, CEO and partner at SeaIntelligence Consulting. “Placing a ban on blank sailings is essentially a non-issue right now in a tight market, but it is highly likely we will see another downturn ahead of us, and if carriers are barred from managing capacity, this becomes problematic.”

In what is still very much of an evolving scenario, carriers are digesting what they were told by the Chinese government and how it will impact their businesses going forward. Unlike the European Union, which declined to impose additional requirements on alliances in renewing the bloc exemption for consortia for five years last fall, China can act swiftly and create major market impact, as it did in 2014 when it shocked the industry by rejecting the proposed P2 alliance of Mediterranean Shipping Co., Maersk and CMA CGM. MSC and Maersk ultimately created the 2M alliance, while CMA CGM joined the Ocean Alliance with Cosco, OOCL, and Evergreen.

In an interview with JOC.com, Jensen said that the reported capping of spot rates by Chinese authorities would have limited impact on the market, considering that spot rates were unlikely to remain at their current levels much longer anyway. More relevant is the question of how Chinese authorities would address capacity management in practice, as carriers’ ability to swiftly withdraw capacity to meet lower volumes in the second half will be key to their newfound profitability which was based on doing precisely that in the first half, he said.

“I as a carrier can either have a scheduled service and I end up blanking half of the sailings, or I say I have no service, but I ad hoc put in extra loaders. It’s the same effect,” Jensen said, suggesting capacity could be difficult even for China to effectively regulate in practice. “Thus, this could range from a non-issue to something that is destabilizing if suddenly the carriers aren’t able to effectively manage capacity. Capacity management as we have seen in 2020 is absolutely pivotal to carriers financial health.”

Chinese regulators on Friday asked carriers how much trans-Pacific capacity has been suspended between July and October; what percentage of their volume is spot cargo; how spot rates are established; why spot rates have increased; and what carriers are doing to curb freight rates, according to an MOT document obtained by JOC.com. Regulators also noted the decline in oil fuel prices and port fees at some cargo gateways this year, and asked carriers how they are disclosing to shippers reduced fuel surcharges due to lower bunker fuel prices.

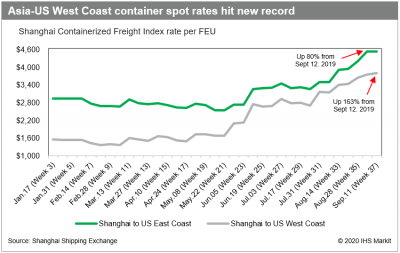

Eastbound container line spot rates from Shanghai to the US West Coast rose 1.5 percent from the prior week to $3,813 per FEU, hitting yet another new record after six straight weeks of increases, according to the latest reading of the Shanghai Containerized Freight Index (SCFI), as published on the JOC Shipping and Logistics Pricing Hub. Container spot rates from Asia to the West Coast are up 163 percent from a year ago.

Pricing to the East Coast dipped 0.1 percent on a sequential basis to $4,534 FEU, but was still up 80 percent from the same week last year, according to the SCFI.

Restricting container capacity management comes with perils

Should capacity management be reined in?

As Pacific spot rates continue to set new records, there is also growing discontent amongst (some) shippers about this state of affairs. While there are a number of different issues involved in how the market got to this point, it is indisputable that a key element has been the carriers’ approach to capacity management.

From a simplistic approach it could be argued that carriers should not be allowed to use capacity management to unduly put upward pressure on the freight rates when we are in an oligopoly situation, as essentially 3 entities — 2M, THE Alliance, and Ocean Alliance — control the capacity.

But when this position is examined more closely, it reveals significant problems.

Predicting actual market demand in individual weeks in the container shipping markets is notoriously difficult with any significant degree of accuracy. Not for lack of trying, but it is a situation where quite often even the shippers themselves are not certain of their own tactical forecasts. This means that carriers essentially have to choose between operating too much capacity and therefore be able to accommodate weekly unpredictable fluctuations in demand, or operate capacity in line with the market average. Choosing the latter would, effectively, mean that cargo would be rolled in 50 percent of all departures.

Restricting the carriers’ ability to blank sailings would therefore lead to either overcapacity or frequent rollings. As is well known to all participants, the “natural” state of affairs has for years been one of overcapacity for the majority of the time. Overcapacity means empty slots for which someone would have to pay. Either the existing shippers need to pay higher rates to cover the cost of no blank sailings, or the carriers would have to absorb the costs of underutilized vessels. The latter has in essence been the case for years, which has also led to a situation where the industry has been outright value-destroying for many years. A situation which is not tenable in the long run.

Hence, this boils down to a logical conclusion whereby the market would need to settle on one of two options: Either the freight rates need to be higher and reflect the true cost of running with low utilization but without blanking sailings. Or the freight rates can be low, but with frequent blank sailings (and extra loaders at a premium) catering for swings in demand. The first is more stable, but also comes at a premium; the other has lower immediate transactional costs, but increases the need for buffers and last-minute flexibility in the supply chain for the shipper.

Both of these options are viable, and the carriers are free to offer any of these to their clients. It would appear that for many years they have been offering the hybrid option of few blank sailings and low transactional prices at the same time and lost money doing so. This is now changing, and for now we are clearly seeing a swing toward a more active use of blank sailings.

Advanced warning for blank sailings

But, it might be argued, carriers should be under an obligation to announce blank sailings with sufficient advanced warning to allow shippers to adjust accordingly. But this also becomes problematic as a regulatory tool. An advance warning of approximately four weeks would suffice for most shippers, but in order to do this it becomes necessary to be able to also forecast demand fairly accurately four weeks out into the future. This is to a large extent what the carriers had been doing in 2018-19, where most of the time advance notices were indeed given three to four weeks out. This has also led to gradual strengthening of financial performance.In 2018-19, it therefore appears that the carriers’ approach was indeed to strike a commercial balance between the upside of blanking sailings versus the disruption this caused to shippers. And this without the need for regulatory intervention.

Using 2020 as a starting point for looking at potentially reigning in this dynamic would appear premature. No one could predict the advent of the pandemic and therefore plan the associated blank sailings four weeks in advance. Once the market had collapsed, it also appears that there was no one at the height of the impact who with a monthlong view also predicted the upturn. And right now where rates are setting new records, the problem is not blank sailings, as there are none — the carriers are running at a higher capacity than last year, not lower capacity.

Additionally, as a final notice, there is the hypothetical argument that shippers might indeed be willing to pay for the certainty that sailings will not be blanked. But it should be remembered that this by definition also comes at a cost of higher carbon dioxide (CO2) emissions as it by default means running more ships than necessary.mThis is not to argue whether the carriers have struck the exact right balance between blank sailings and freight rates as in 2018-19; the verdict on this is likely highly diverse across a range of shippers and carriers. But it is to outline that the notion of regulatory intervention related to capacity management appears to have been unnecessary prior to the pandemic impact and would potentially have been detrimental during a sudden unexpected disruption.

FMC tells trans-Pac carriers it’s monitoring blankings, ‘revenue trends’

The US Federal Maritime Commission (FMC) has served notice to carriers and vessel-sharing alliances that it is closely monitoring blank sailings, utilization of equipment, and “revenue trends” in the current volatile environment in the eastbound trans-Pacific.

Although the commission does not plan any immediate action, the FMC said in a statement Wednesday steps could be taken if it detects possible anti-competitive behavior by carriers. The FMC could launch a fact-finding investigation or even petition a federal court to take legal action.

“If there is any indication of carrier behavior that might violate the competition standards in section 6(g) of the Shipping Act, the commission will immediately seek to address these concerns with the carriers. If necessary, the FMC will go to federal court to seek an injunction to enjoin further operation of the non-compliant alliance agreement,” the commission said.

Wednesday’s message from the FMC followed one delivered Friday by mainland China’s Ministry of Transportation and Communication (MOT), which suggested in a Shanghai meeting that carriers in the eastbound trans-Pacific add capacity and be less aggressive in increasing freight rates to protect the competitiveness of Chinese exporters.

FMC spokesperson John DeCrosta told JOC.com Thursday the commission’s announcement was not tied to MOT’s statement or any single event in the trans-Pacific. Rather, the FMC staff continually monitors conditions in all of the US ocean trades, he said, regularly receiving non-public comments from beneficial cargo owners (BCOs), non-vessel operating common carriers (NVOs), and other industry stakeholders via email and letter regarding those trades.

Wednesday’s closed-door meeting of the FMC focused on trade conditions in the eastbound trans-Pacific and the carriers’ response to trade flows during the COVID-19 pandemic, DeCrosta said.

Increasing volatile conditions owing to COVID-19

US imports from Asia have been on a roller-coaster ride this year. Imports plummeted during the factory closures in mainland China during the Lunar New Year and the outbreak of COVID-19 there in January and February, and during the US lockdowns this spring. Carriers blanked about 200 sailings from February through June in response to declining imports, according to Sea-Intelligence Maritime Analysis.

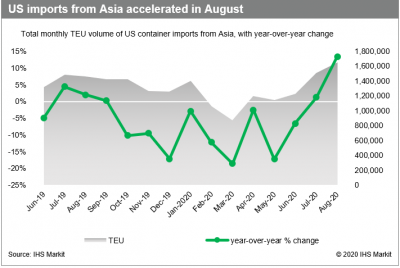

However, carriers apparently blanked too many sailings and were caught with insufficient capacity when imports surged this summer. US imports from Asia increased 13.4 percent in August from August 2019, and 16.5 percent from mainland China, according to PIERS, a JOC.com sister company within IHS Markit.

Click to enlarge.

Spot rates exploded as a result, increasing last week to a sixth-consecutive record high of $3,813 per FEU to the West Coast and $4,534 to the East Coast. That was up from $1,678 per FEU to the West Coast and $2,543 to the East Coast on May 22, according to the Shanghai Containerized Freight Index published in the JOC Shipping & Logistics Pricing Hub.

DeCrosta said carriers, either individually or part of vessel-sharing alliances, are subject to ongoing scrutiny by the commission for any actions they take that could involve or even hint at anti-competitive behavior.

Reaction from carriers and NVOs to FMC’s statement was mixed. A carrier spokesperson who did not want to be identified said conditions in the Asia-North America trade have been so volatile during the COVID-19 crisis that no one, including retailers, have been able to predict with any certainty what import volumes would be like more than a month or so out.

The escalation in spot rates since June was a reflection of demand outstripping the capacity carriers had deployed based upon the best information they had at the time, the source said. Complaints from BCOs or NVOs about carriers allegedly restricting capacity to push spot rates higher is “outright whining about rates,” he said.

An NVO said anyone who looks at the rate sheet that carriers provide to their customers and sees a charge of $300 per container for a guarantee of equipment or $500 per container for a guaranteed slot on a vessel can figure out that carriers are profiting from tight vessel and equipment conditions. “That’s when the FMC should step in,” the NVO source said.

A second NVO source said that despite the actions taken this past week by mainland China’s MOT and the FMC, he is bracing for additional rate hikes, such as an Oct. 1 general rate increase, and premium charges for equipment and space guarantees.

“I don’t think the carriers will have any fear of the FMC until they are held accountable,” the NVO said.

US SE ports see uneven volume rebound in August

Container volumes at the major Southeast and mid-Atlantic port gateways are rebounding, with Charleston and Virginia both registering double-digit percentage sequential growth in August and Savannah notching its best single month ever for container throughput.

Port officials say the sudden shift in cargo demand is the result of consumer demand for home furniture, home office equipment, home improvement goods, and a sharp rise in e-commerce, as Americans substitute spending on out-of-town vacations for a better home experience.

The Georgia Ports Authority (GPA) handled more than 441,600 TEU in August compared with 437,747 TEU a year ago, a record for any month in Savannah’s history, according to preliminary figures from GPA.

Cargo volumes have been surging through the ports of Los Angeles and Long Beach since late July, driven primarily by imports of e-commerce goods and personal protective equipment from Asia. US imports from Asia in August jumped 9.8 percent compared with the previous month and 13.4 percent from the same month last year, according to PIERS, a JOC.com sister company within IHS Markit.

GPA CEO Griff Lynch said he anticipated August would be better than June and July, but he was surprised last month was record-breaking.

“We had no idea this was going to happen. I can’t tell you I saw this coming. Our economists told us there were sectors that would do well, but we didn’t think it would be enough to overcome the fallout of the pandemic on other industries,” Lynch told JOC.com Wednesday.

European trade slower to return

Savannah is the only major US Southeast port to see its container throughput grow on a year-over-year basis in August, but its competitors have seen a strong rebound sequentially compared with the height of pandemic. Port authorities tell JOC.com they expect volumes to remain strong through the end of this month, but uncertainty surrounding the COVID-19 pandemic continues to cloud the outlook for the traditional peak ocean shipping season.

The Port of Virginia handled 247,349 TEU in August, down 4 percent year over year, but up 23 percent from the 2020 low point in May, according to the Virginia Port Authority (VPA).

“We are seeing some green shoots and trending in the right direction, and we must temper that with the fact that the trade environment is very fluid and unpredictable,” VPA CEO John Reinhart said. “This month-on-month growth should continue through September, but it is hard to predict what volumes will look like in late fall.”

Volumes flowing through the Port of Charleston fell 10 percent year over year to 208,837 TEU in August, according to the South Carolina Ports Authority (SCPA). But that was still better than the height of the pandemic, when monthly volumes were down between 15 and 20 percent compared with 2019.

SCPA CEO Jim Newsome said cargo volumes there haven't recovered as quickly because Charleston has less exposure to retail goods than other East Coast ports.

“We are not as much focused on omnichannel retail as other ports, but our focus is changing as shown with this week’s Walmart announcement,” Newsome told JOC.com, referring to a $21.6 million federal grant the SCPA will use to build out the Ridgeville Commerce Park with a 3 million-square-foot Walmart distribution center.

Charleston also has more exposure to European trade, which has struggled as COVID-19 infection rates in the EU — and related restrictions on businesses — remain higher there than in Asia. Northern Europe accounts for 30 percent of Charleston’s imports compared with approximately 20 percent in Baltimore, Virginia, and New York and New Jersey, and less than 10 percent in Savannah. European imports to the US grew 2.8 percent year over year in August, but declined 10 percent into Charleston, 12 percent in Baltimore, and were flat in Virginia.

Replacing vacations with home improvement projects

William Doyle, executive director of the Maryland Port Administration, said August results haven’t been released yet, but similar to Charleston and Virginia, Baltimore’s volume will be stronger than in previous months, but not as high as a year ago. He added, however, that September totals could beat 2019 levels because of business from e-commerce giant Amazon, as well as traditional retailers such as Rite Aid, Big Lots, Restoration Hardware, and Levin Furniture.

As in Los Angeles and Long Beach, the strongest driver of growth for Southeast ports in August was home furnishings, a category that includes furniture, bedding, mattresses, cushions, lamps, and lighting fittings. Imports of those goods rose 73 percent in Los Angeles compared with August 2019, 46 percent in Savannah, 24 percent in Charleston, 8.7 percent in Virginia, and 5.7 percent in Baltimore, according to PIERS.

Companies such as Ikea, Rooms to Go, and E&E Furniture showed some of the largest increases in container traffic last month compared with 2019, PIERS data showed.

Tractor Supply Company also imported more containers through Savannah and Baltimore year over year in August, including an increase in hand tools such as spades, shovels, and hoes, and materials for roofs, doors, and windows, as Americans spend more time fixing up their homes.